Under the Indian system, I suppose its not possible for states to be even partially self sufficient in raising funds at the local level. Last time I checked, the centre allocated around 30% of the annual revenues to the states (combined).

So during revenue collection, money moves from the bottom to the top passing through various levels and from the top to the bottom in reverse when allocating to the states. This back and forth movement of capital is perhaps the greatest breeder of corruption and in-efficiency. With leaks everywhere at every level, no wonder this is called the trickle down effect. Its really a trickle when it reaches the lowest level.

Anyways, I would like to highlight an interesting comparison. I got a mail from the "Department of Tax Administration" of the County of Fairfax, Virginia. It was time to pay my taxes for holding a vehicle. They call it the Personal Property Tax Bill. And it neatly mentiones the Tax period, the Tax Amount, the Car tax relief, etc. And also tells me what all ways I have to pay the bill.

Along with the bill is a Tax Department addressed envelope incase I wished to mail the payment. And along with that I found a brochure titled "Tax Facts". Its was a neat write up of various taxes and licenses in the county and other nice to know information.

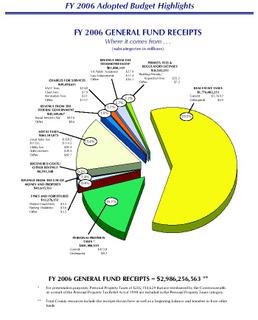

And then there was this "Fairfax County FY 2006 General Fund". It was a pie chart and thats what caught my attention.

The chart simply shows "Where the money comes from...." and I was astonished to see that the total Receipts for Fairfax county (equivalent to a district in India) was to the tune of USD 2.9 billion !!

And what is more interesting to note is the percentage of receipts from external sources namely the state and federal level -

According to the chart :

Revenue from The Federal Government is just 1.5 %

Revenue from the State (Commonwealth) is just 2.7 %

The county generates all its revenue, all by itself, at the local level with very scarce contribution from the federal and state levels.

I am not an economics student but I suppose anybody would agree that in India too, the ritual of annual handouts should be done away with and slowly be replaced with local level revenue generation and utilization instead of the back and forth in practice now.

And by this I not only mean at the state level but right upto the village panchayats that need to be financially independent to take up development activities without looking back over their shoulders.

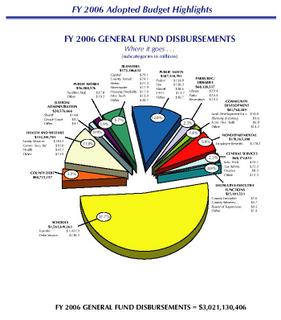

And for your reference see below the Disbursement pie chart showing how this money is spent by the county.

9 comments:

Eshwar,

Agreed, in India devolution of powers is yet to be achieved.

If devolution of powers is achieved then what will our Ministers in the Parliament do

;-) ?

I think India's parliamentary democracy is the culprit, since it provides more power with the centre and less power to the states and then even-less power to the panchayats and other local bodies(power = Administration). When it comes to foreign policy/defense, I think we need a strong centre!

Remember, R Venkatraman(former President of India) also has suggested that India should follow the American system(of federalism) rather than the British system(of centralism).

What do you suggest?

excellent eshwar.

Lets assume lot of these are decentralized, where will be accountability.

Will they do their job?

But I am all for this method.

Apparam these state govt cant blame central for every single adminstrative failure :)

Sancho...i suppose India is already in between the british model and american model.

But my case in point was financial devolution and not just political devolution to the states. Though one effects the other, I for now believe that financial devolution is the need of the hour. But we could always debate the pros and cons of it for better understanding the issue.

Ganesh....I suppose accountability will also be "federalized" and yes the states will have to blame themselves incase of non-devliveries then !!

Esh,

The idea is good on paper...and to make it work, we the people are equally responsible...For states to generate an income, We have to pay our taxes properly...

How many people buy Jewellery with a proper reciept?

How many people do House Registration for correct property value?

nice one.I also got the prop tax thing.i was so up set that didn't look anything beyond that :).

check out this link.

http://www.outlookindia.com/full.asp?fodname=20050905&fname=karnataka+%28F%29&sid=1

Sen...thats amazing. Really a fantastic start. Good luck to the Govt and ppl of Karnataka. Hope the rest of the states follow the example.

Eshwar,

You dont take into account the fact that, all revenues that are 'generated' by local county essentially equals, all revenue that state has agreed to let go.

1) Revenue from state&fed = subsidy

2) all taxes, property,income,realestate etc goes to local county only

in india, everything goes to state/centre directly and gets disbursed back to districts

But one major difference is accountability and decentralization(as ganesh pointed out)

Here, county makes up its policies about tax rates, levies etc and hence they are accountable to the people directly !!!!

Arvind...thats exactly my point. The Center / State has to delegate. Else it will be unmanagable.

And I do understand that the devil is in the detail !!

eshwar i agree wit u that states shud take car eof their own finances, but there are two problems

1) some states dont possess taxable capicity, for example bihar and UP (dont give me black momey ststs, these states majority r poor and dont have any industries) so sother well off states have to cross subsidise them

2)some states will be able to generate gr8er revenues like maharastre primarily cause many cos have ther registered offices their. hll may pay 100crs as tax, but this is on the income earned from entire nation so one state hoggin it isnt fair

3)average tax rates will go up for the individual and black money will increase wit ur suggestion (in us it is 40%) and its almost impossibble to evade taxes! in india a small pervent pay taxes around 10%(optimistic) and they subsidise the entire natoin, if these ppl r taxed more they r likely to evade taxes

Post a Comment